0151 608 9078

0151 608 9078

When you are in or near retirement, planning for a future of financial security can become a priority for you and your loved ones. Where pension provisions are low and savings are tied up to help support your children and/or grandchildren, property can be your biggest asset. Releasing equity from your home can provide you with a financial boost.

What is Equity Release?

As a homeowner you may have seen the value of your property increase over the years. Equity release is the process that allows you to release cash from your home in order to generate income. There are two main types of plans available: Lifetime Mortgage and Home Reversion.

Lifetime Mortgage Plan

With a lifetime mortgage plan, you take out a loan based on the value of your home and your age. You keep full ownership of your property.

The loan, together with any interest, is repaid when your home is sold. This is usually when you need to move into long-term residential care, or after your death. The loan would only be subject to a possible early repayment charge if repaid in other circumstances. The loan would be transferable to another property should you wish to move with no penalty unless a partial repayment became necessary because of a reduction in the value of the new property.

Reputable schemes offer the ‘no negative equity guarantee’ which means that the repayment will never exceed the value of your property.

Alternatively, interest-only lifetime mortgages are also available. With this plan, you repay the interest on the loan which means that the original mortgage balance will remain exactly the same for the lifetime of the mortgage.

Some providers will offer a ‘drawdown’ facility. This allows you to take smaller amounts as you need to rather than a lump sum at the start.

Home Reversion Plan

With a home reversion plan, you sell your home, or a percentage of it, to a reversion company for a fixed amount.

Under the conditions of this plan you would no longer own your home, or you would only own a part of it. A lease is provided giving you the right to live there rent-free for your lifetime or until you have to move into residential care. With some arrangements you pay a token rent.

There is no loan to repay with this plan; however the reversion company receive its contributing percentage of the sale proceeds when the property is sold after you have left it. For example, if the reversion company purchases 60% of your property it will be entitled to 60% of the sale value when the property is sold. The reversion company would usually only pay you a smaller % in cash than they are actually purchasing from you.

Exit penalties are often included within equity release products so it is important to note any potential financial implications should you decide to leave the scheme early. Equity release plans expire upon death, or if you have had to leave the property earlier than planned, for example you may need to be placed into a care home when they become repayable within a fixed timescale (usually 12 months).

Regulations

• Lifetime Mortgages and Home Reversion Schemes are regulated by the Financial Conduct Authority. This means that there are rules about what providers must tell you when you take out an equity release plan;

• If they do not follow these rules and something goes wrong, you have the right to seek redress through the Financial Ombudsman Scheme;

• If you take out a scheme with an unauthorised provider, you will not be able to use the complaints and compensations scheme;

• It is important to check with the Financial Conduct Authority that the firm you are dealing with is authorised.

To find out more about our services, contact a member of our Private Client team today on 0151 608 9078 or complete our online enquiry form.

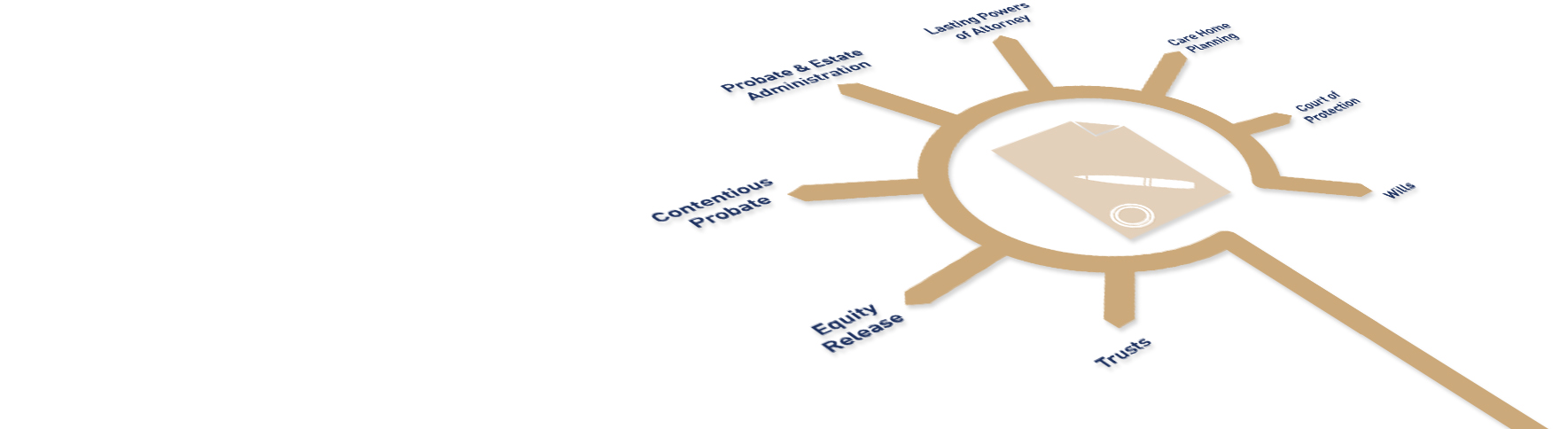

There are many things to consider when preparing for your future but did you know that there are various legal arrangements available to help you put your plans in place today?

To find out more download our guide.

Download Here >Making time to organise your affairs can be the last thing on your mind when you are enjoying the present, but having the right plans in place today can help you and your family in the future.

Download Here >Allocating a Lasting Power of Attorney (LPA) is vital to protect your future.

To find out more download our guide.

Download Here >Simply complete the online enquiry form below and our Wills & Estates team will contact you.

Let Kirwans guide you on your legal journey.