0151 608 9078

0151 608 9078

You should always seek advice from a qualified independent financial adviser. ‘Independent’ means they are not restricted to selling schemes from just one or two firms.

When choosing a financial adviser:

• Check that your adviser is authorised by the FCA;

• Understand whether your adviser is independent or tied to a particular provider;

• Check whether your adviser has passed the relevant exams and is qualified to deal with equity release;

• Ensure your adviser understands your circumstances and discusses different options with you, not just one;

• Always review documents and forms carefully before signing anything.

Costs

The costs and fees of setting up equity release plans will vary between different providers.

Typically the costs will include:

• Completion, arrangement or application fees that cover administration costs;

• Valuation fees which vary depending on how much your property is worth;

• Legal fees;

• Early repayment charge if you want to pay off your loan early.

To find out more about our services, contact a member of our Private Client team today on 0151 608 9078 or complete our online enquiry form.

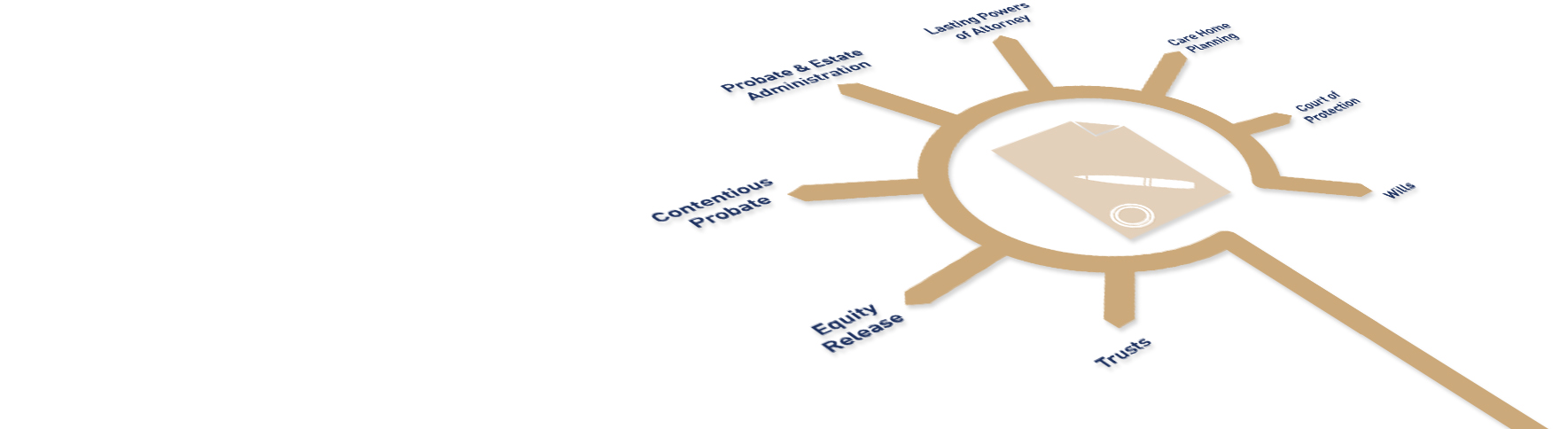

There are many things to consider when preparing for your future but did you know that there are various legal arrangements available to help you put your plans in place today?

To find out more download our guide.

Download Here >Making time to organise your affairs can be the last thing on your mind when you are enjoying the present, but having the right plans in place today can help you and your family in the future.

Download Here >Allocating a Lasting Power of Attorney (LPA) is vital to protect your future.

To find out more download our guide.

Download Here >Simply complete the online enquiry form below and our Wills & Estates team will contact you.

Let Kirwans guide you on your legal journey.